BTL Mortgage Shift

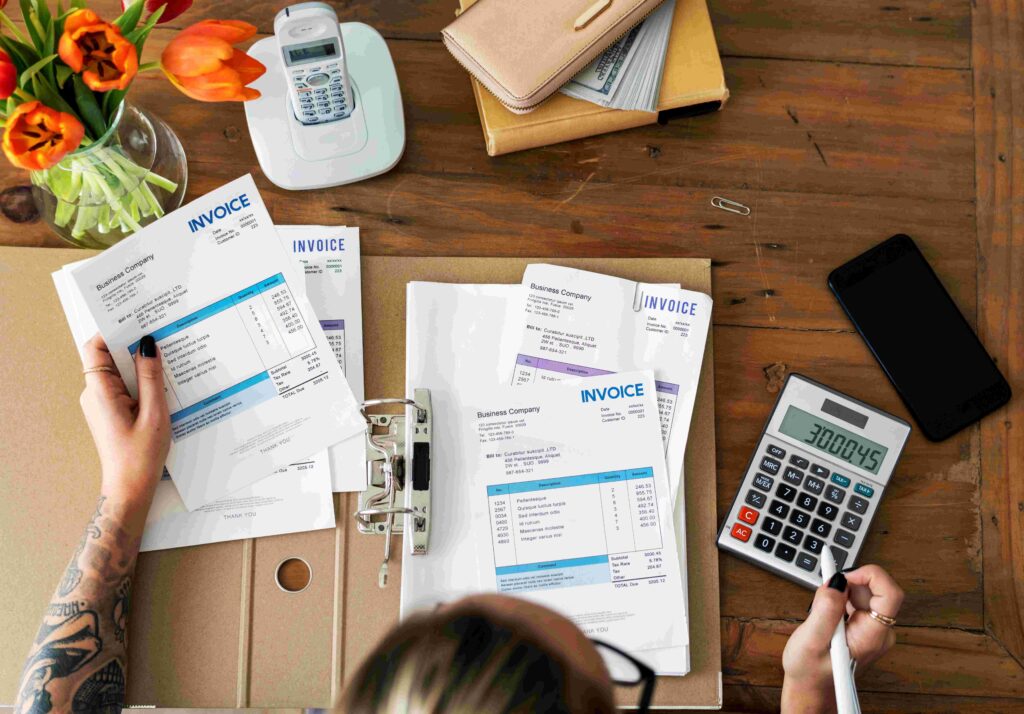

In the current financial climate, marked by higher interest rates, the landscape for buy-to-let (BTL) mortgages is evolving. Lenders, faced with increasing costs of funds, are adapting their offerings. Many now present a range of mortgage products that feature a compromise: lower interest rates coupled with higher arrangement fees. This strategy aims to address the affordability challenges landlords face, enabling them to either refinance existing properties or invest in new ones under more manageable terms.

The rationale behind this approach is straightforward. By lowering interest rates, the measure of rent income versus loan payments is improved, simply because the lower interest rate results in lower regular loan payments. This can help a borrower to demonstrate the required level of borrowing costs cover, whilst achieving the required loan amount. The lender doesn’t lose out by offering the lower interest rate because they have charged a higher fee, which is typically added to the loan balance and repaid gradually over, say, 25 years, except where an interest-only product is used. This model can be particularly beneficial for borrowers whose rental income margins have become tighter due to the prevailing higher-interest-rate environment.

It’s important to note that while these lower rate/higher fee products can offer more borrowing capacity or maintain investment viability, they are not typically cheaper in the long-term.

The market’s response to these evolving mortgage products is mixed. While some view the approach as a valuable adaptation to maintain the viability of BTL investments, others offer caution. This underscores the importance of careful consideration, good research, and expert advice and support to match the right solution to the borrower’s specific circumstances and needs.

Fit To Lend: Specialist in Commercial Finance, offering advice, support, and a comprehensive range of solutions.

FINANCE MADE CLEAR, SUCCESS MADE POSSIBLE

Supporting Business With Finance That Fits

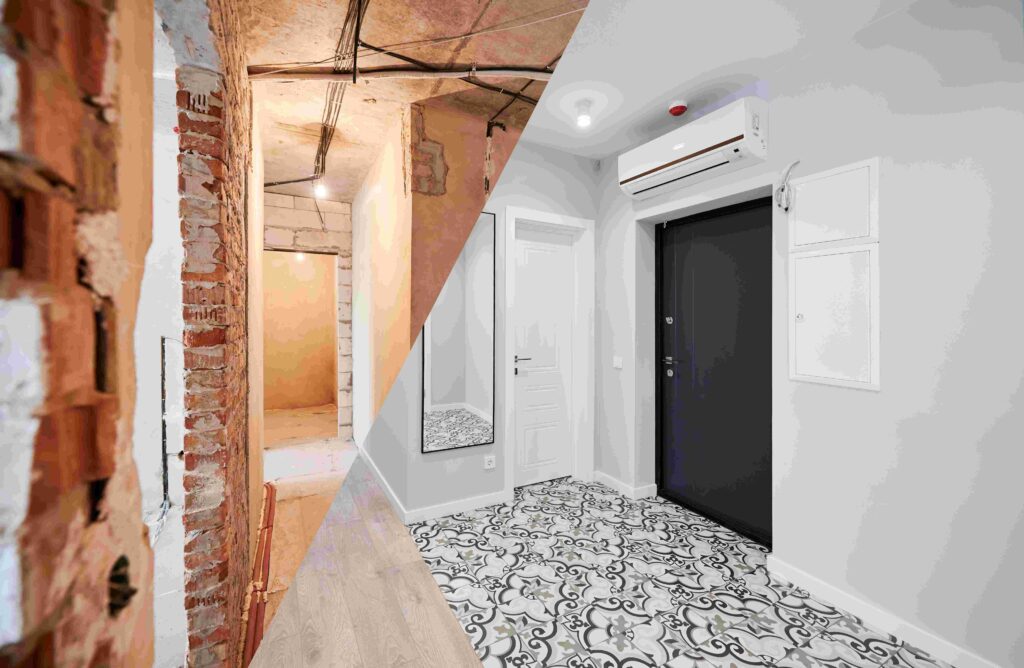

Property finance products

other business finance products

YOUR PROJECT, OUR MISSION

Supporting Business With Finance That Fits