HMO Finance

Long-term finance for investment in Houses in Multiple Occupation

HMO Finance

HMO Finance facilitates the acquisition or refinance of properties where multiple unrelated tenants share common facilities, like the kitchen and/ or bathroom, characteristics that define a property as a HMO. This type of finance is accessible to both experienced HMO investors and newcomers. While some HMO financing may utilize products not exclusively designed for HMOs, such as certain buy-to-let or commercial mortgages, the array of product options is extensive. Regardless of the product chosen, the primary source for repayment typically stems from the rental income produced by the property. Below, we provide insights to aid your decision-making before initiating a detailed discussion and application with us.

YOUR PROJECT, OUR MISSION

Supporting UK businesses with access to Finance That Fits

HMO Mortgage Types

Navigating through the array of financing options for Houses in Multiple Occupation (HMOs) can be a complex endeavour, but don’t worry – we’re here to help, and below is an overview of the mortgage types you might consider for an HMO investment:

Interest-Only Mortgages: Common for HMO financing, these mortgages require payment of only the interest each month. This can be particularly beneficial for cash flow management in HMOs, where rental yields are typically higher. The capital is usually repaid through refinancing or the property’s sale at the end of the term.

Repayment Mortgages: A repayment mortgage involves monthly payments of both interest and capital, leading to an unencumbered property at the end of the mortgage term, or repayment profile. This could be a strategic choice for long-term investors focused on building equity.

Fixed-Rate Mortgages: Offering an interest rate that remains constant for a set period (e.g. 2, 5 or 10 years), fixed-rate mortgages provide predictability in your financial planning, shielding you from market fluctuations during the fixed term.

Variable-Rate Mortgages: With rates that can change over time, these mortgages reflect the current market conditions, offering the potential for lower rates but also the risk of rate increases.

Tracker Mortgages: These mortgages track an external rate, such as the Bank of England base rate, plus a set margin. They offer transparency and can be advantageous when external rates are low.

Discount Mortgages: Starting with a discount on the lender’s standard variable rate, these mortgages can lower initial costs, which might benefit short-term investment strategies.

It’s important to note that there are many products in the market that can fund an HMO which are not specifically branded as HMO products. For instance, certain Buy To Let Mortgages or Commercial Mortgages could be well matched. Moreover, if your HMO is part of a larger portfolio, Property Portfolio Finance could offer a consolidated solution that simplifies your holdings under one loan facility.

At Fit To Lend, we understand that each client and each investment is unique, so the financing solution needs to be carefully considered and well matched. That’s why a detailed discussion about your specific requirements is crucial. Let’s start a conversation now about how we can help.

Borrower Type

The borrower structure can be pivotal in HMO financing, as it influences tax treatment and loan availability. With a limited company structure, rental profits are taxed under corporation tax, and mortgage costs can be offset against profits, thus reducing the tax payable.

In personal ownership, personal tax rates apply to rental income, and in recent years changes to mortgage interest relief have increased tax burdens for some landlords.

The choice of structure may also affect borrowing capacity. Lenders typically consider the net rental income available for loan repayments, meaning that post-tax income can significantly impact the amount they are willing to lend. For personal owners, individual tax bands can play a role in these calculations, possibly affecting available loan amounts.

Balancing these factors can be complex, and we recommend that you obtain tax advice. Whatever structure you adopt the financing solution needs to be well matched, and we can help you with that.

The Lender's View

Lenders exercise a high degree of diligence when assessing HMO finance applications, given the unique nature of these investments. Here’s what they typically scrutinize:

Financial Health and Viability:

The financial robustness of the HMO is analyzed through its loan-to-value ratio and the sufficiency of rental income to cover loan repayments. A strong rental yield, typical of HMOs, can positively influence a lender’s decision by showing the potential for reliable income generation.

Borrower Experience and Expertise:

Experience managing HMOs is particularly valued because of the intensive management they require. Lenders may look favorably on applicants with a history of efficiently managing HMOs or similar types of properties. For those new to HMO investments, demonstrating solid plans for management and upkeep can be pivotal.

Income Generation and Asset Liquidity:

Lenders prioritize the HMO’s capacity to generate adequate income for servicing the loan. They’ll assess the property’s historical financial performance and the likelihood of continued demand for tenancies. The liquidity of the HMO may also be a consideration, reflecting its potential resale value and ease of exit should circumstances necessitate it.

HMO Licensing and Planning Consent:

A crucial factor in the lender’s assessment is the presence of the necessary HMO licensing and planning consent. Fit To Lend will work with you from the outset to review these critical details, aiming to identify and address potential issues early in the application process or before they arise during legal due diligence.

In essence, while each lender’s approach may vary, their primary objective is to ensure the loan is backed by a solid investment proposition. This includes not only the financial aspects but also the legal and operational readiness of the HMO property. Fit To Lend is committed to guiding clients through this intricate landscape, ensuring your application reflects the strength of your investment and operational plan.

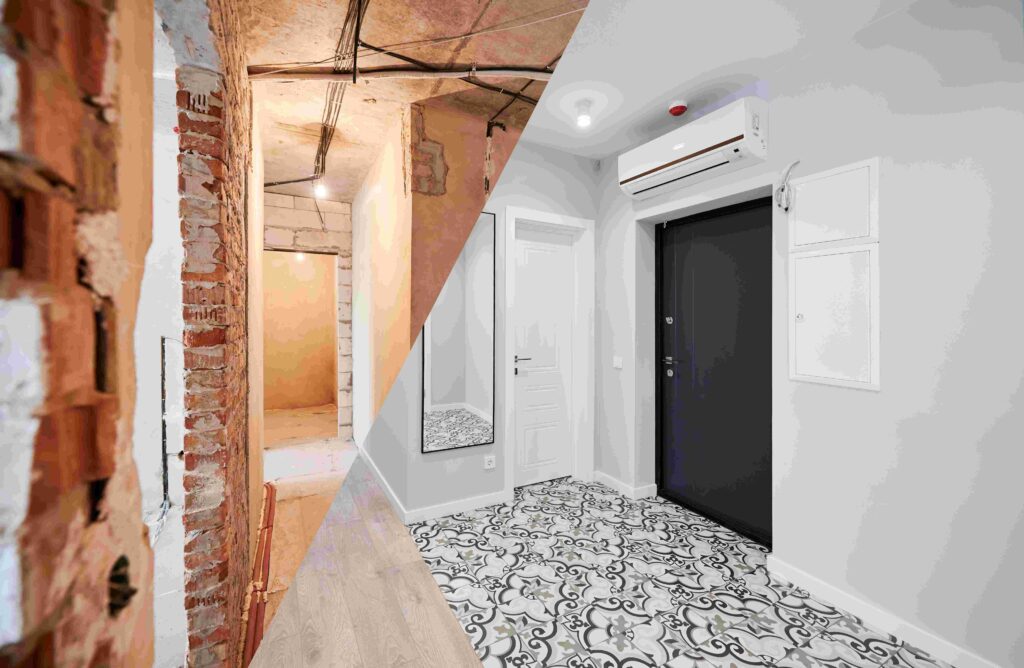

Converting a property to HMO

Transforming a property you own or are acquiring into an HMO can substantially increase rental yield, especially areas where there’s a high-demand for smaller living spaces. It’s essential to carefully plan your financing strategy if you’re contemplating such a conversion.

If there’s an existing mortgage on your property, you might encounter restrictions on construction or a need for additional funds to finance the conversion. Beyond the requirements for planning, licensing, and regulatory compliance, securing the right financing is crucial. The options vary, catering to the extent of construction, property size and other factors.

Property Refurbishment Finance could offer a suitable solution. Some products within this category allow for a single financing solution that remains in place from the start, with the potential for a pre-agreed increase based on the post-construction value of the property. Other products provide two distinct facilities from the outset: a bridge-type facility for funding until construction ends and a subsequent long-term mortgage-type facility, typically larger than the first, for after the work is complete. Alternatively, separate arrangements may begin with Bridge Finance, followed by long-term HMO Finance. Development finance with stage-released funds may be appropriate for larger projects.

Fit To Lend is ready to discuss your HMO conversion project and identify the most suitable financing solution.

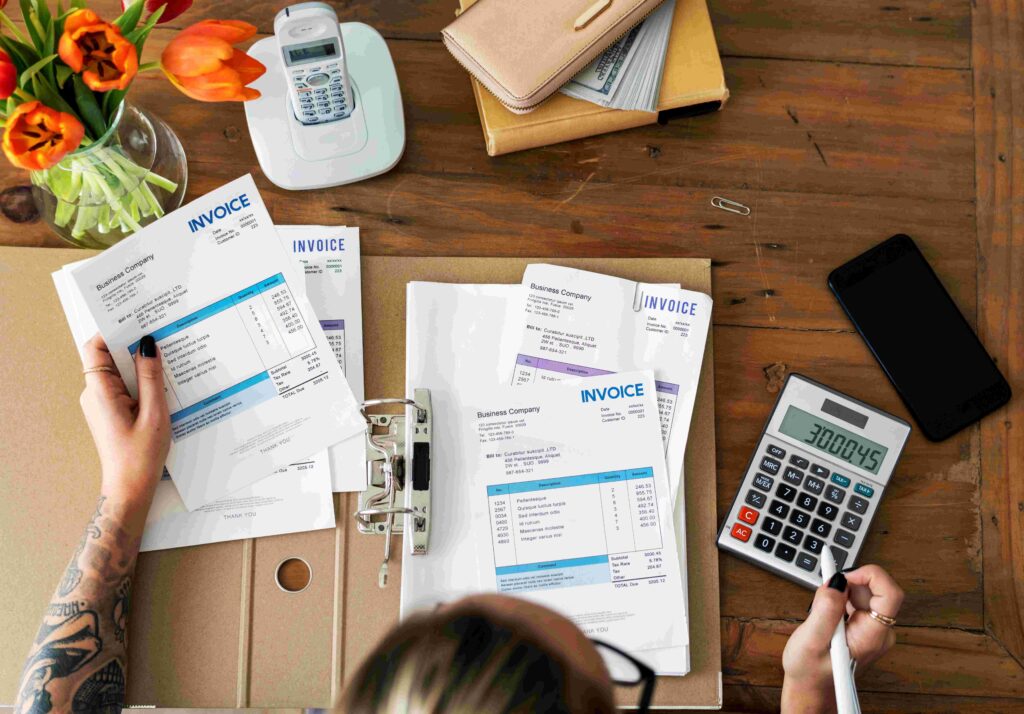

The application, approval, and completion processes

The application process for HMO Finance involves preparation and presentation of initial information, and then further information documentation as the application progresses. Fit to Lend offers comprehensive support throughout this journey, beginning with an assessment of the borrower’s circumstances, needs, and plans. We specialize in identifying the most suitable product, ensuring it aligns with the borrower’s objectives.

Our role extends beyond facilitation; we strive to craft a credible and compelling proposal to enhance the likelihood of lender approval. By remaining actively involved at every stage—liaising with borrowers, lenders, valuers, and solicitors—we navigate the complexities of the process to meet your timeline. Our commitment is to ensure that from initial application to final completion, every step is handled with diligence and expertise, minimizing delays and aligning with your investment goals.

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Finance Solutions

questions

&

Answers

Yes, we charge a transparent and fair fee of 0.5% that's typically payable at the end when the loan completes, and in our opinion borrowers should be extra cautious if a broker ever offers to work without charging fee. In these circumstances the broker's income may be based solely on commissions paid by lenders, and commissions vary significantly between different lenders, so the borrower needs to be confident that the broker is not inappropriately influenced by lender commissions. It is critically important that the broker has the borrowers best interests front & centre when presenting choices and making recommendations. Our fee is modest, and if you take a look at what it represents as a portion of borrowing costs over the loan term, you'll see why we're confident it will be far outweighed by the savings we achieve for borrowers and the value of the close support and guidance we provide.

HMO finance is a mortgage used to funds properties rented out to multiple tenants with shared facilities.

Both individual landlords and limited companies can apply for HMO finance.

Yes, typically, HMO mortgages have higher interest rates due to the perceived increased risk for lenders.

First-time landlords can secure HMO finance, but we may have to work a little harder to find a willing and suitable lender.

That depends on the local licensing and planning rules where the property is located, but if one is required then the lender will expect compliance with the rules.

HMO Finance caters to properties with multiple tenancies and involves different risk assessments and lending criteria. Some Buy To Let Mortgages will support HMO purchase, but many are not suited.

The maximum LTV for HMO finance typically goes up to 75-85%, depending on the lender.

The process can take anywhere from a few weeks to a few months, depending on the complexity of the case. There are things we can do to help a case move faster if time is of the essence.

Fees can include arrangement fees, valuation fees, legal fees, and broker fees. Dependent on various factors, some lenders offer low/ no cost valuations, and low cost legal fees.

Some HMO Finance products can allow for building work to be carried out, depending on the extent of the building work, and depending on the lender.

Your tax bracket can affect the rental income calculations for loan serviceability and, consequently, the loan amount. This tends to be most relevant f you borrow in your personal name/s, but not so relevant when borrowing in the name of a Limited Company.

Yes, many lenders provide interest-only options for HMO Finance.

Yes, HMO finance can be used for properties let to students, subject to lender criteria.

It's more challenging but possible with specialist lenders, albeit possibly with higher interest rates.

Generally, no. HMO finance is for investment properties, not owner-occupied homes.

Rental income is crucial; it must usually cover at least 125-145% of the mortgage payments.

Yes, lenders offer fixed-term rates, typically ranging from 2 to 5 years, after which you may revert to a variable rate.

There are HMO Finance options that are based on one loan per property, and there are others available that can offer a single loan supported by multiple properties.

make

an

enquiry

News, Views And Finance Clues

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Commercial Finance Solutions

More News, Views And Finance Clues

EXPERT EVALUATION, EFFECTIVE EXECUTION

Supporting UK businesses with access to Finance That Fits