Property Development Finance

For substantial property development projects - Ground-Up or Conversion.

Property Development Finance

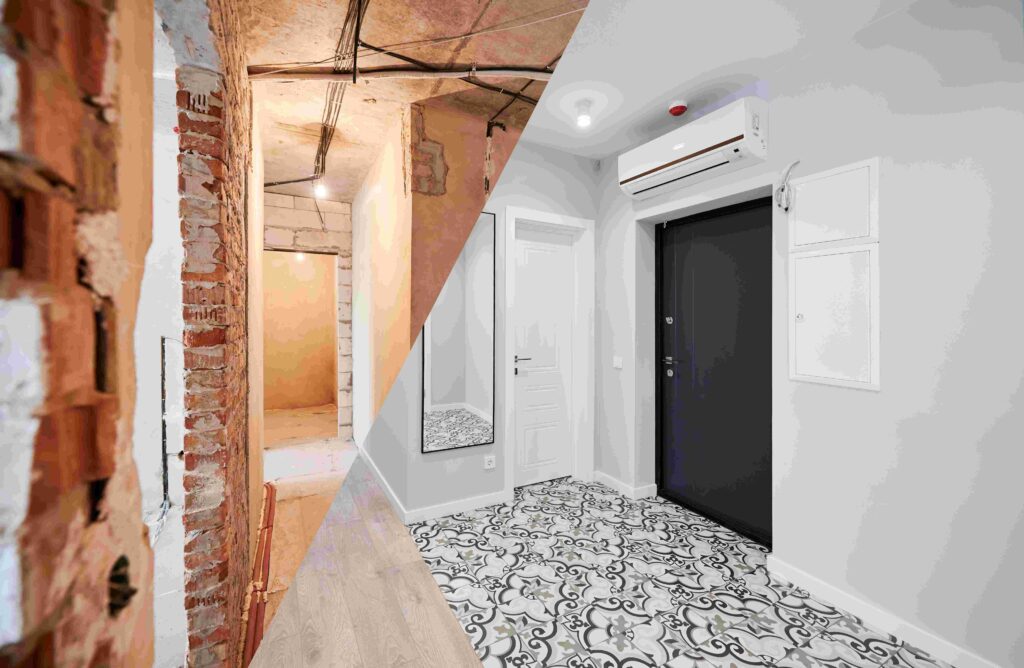

Property Development Finance is a specialised funding solution designed to support substantial construction and conversion projects. Typically suited to ground-up developments or significant conversions like changing offices into residential apartments, this type of finance offers the flexibility and capital that’s required for such projects. Borrowers can typically expect staged drawdowns, interest roll-up options, and bespoke repayment terms. While each lender’s offering may vary, the core characteristics remain geared towards facilitating the financing needs typical of substantial projects.

YOUR PROJECT, OUR MISSION

Supporting UK businesses with access to Finance That Fits

What projects is it used for

Property Development Finance is tailored for large-scale projects. This includes residential new builds, complex renovations, and commercial or mixed-use developments. The product provides the substantial capital needed for developers to realise ambitious property visions.

However, it’s not a one-size-fits-all solution. Smaller-scale projects, such as minor home improvements or single-unit renovations, may find development finance less suitable. This is due to its short-term nature and potentially higher interest rates and fees.

For these smaller projects, alternative financial products may offer a better fit. Options include personal loans, home equity lines of credit, or Buy-To-Let refurbishment products. The latter is particularly useful for landlords looking to make light refurbishments or energy efficiency upgrades to rental properties.

By carefully considering your project’s scope and financial requirements, you can select the most appropriate funding solution.

The Type of Borrower for Development Finance

Typically, lenders in the realm of Property Development Finance are inclined to favour borrowers who have a proven track record in property development. Experience in successfully completing similar projects often equates to lower risk from the lender’s perspective. However, the market does have room for flexibility, and some lenders are willing to consider applications from first-time developers or those with limited experience in the field.

A strong case for securing development finance isn’t solely based on past experience. It also involves presenting a well-defined exit strategy, comprehensive financial planning, and robust market research. A meticulously prepared business plan that outlines the project’s feasibility, profitability, and risk mitigation strategies can significantly bolster your application.

For those who may lack certain skills or financial resources, a joint venture can be a strategic move. Such partnerships can bring together a balanced mix of financing, skills, and knowledge, thereby enhancing the project’s overall viability. A joint venture not only adds credibility to your application but also serves as a risk mitigation strategy, making the proposal more appealing to lenders.

How Much Can You Borrow?

There is no specific maximum loan size for Property Development Finance, but there is limited appetite amongst lenders for loans below £1 million. A small number of lenders offer loans at these lower amounts, if the proposal matches their other criteria. Alternative financing products such as Buy-To-Let refurbishment products, or Bridge Loans can be worth considering for smaller projects.

Lenders are often driven by the loan size as a percentage of the project’s Gross Development Value (GDV), often lending up to 75% of GDV. For those looking to maximise borrowing potential, mezzanine finance can sometimes increase the total lending to near 100% of the project’s total costs.

In some cases Joint ventures can be a good way to pool resources and expertise, potentially securing more favourable terms and higher borrowing limits.

Specialist sales guarantee products are also available to guarantee the sale of the units once they’re built, providing additional security for both developers and lenders, and also having the potential to increase the amount of available funding.

Types of Borrowing Structures

When securing Property Development Finance, the structure of your borrowing entity is crucial. Options range from using a single company for all projects to creating a Special Purpose Vehicle (SPV) for each scheme, or even operating as a sole trader or in an unincorporated partnership.

- Single Company for Multiple Projects: This approach simplifies management but could expose all projects to the financial risks of any single one.

- Special Purpose Vehicle (SPV): An SPV is often the preferred option as it isolates financial risks to a specific project. It may also offer tax benefits, especially for higher-rate taxpayers.

- Sole Trader or Unincorporated Partnership: These structures are simpler but expose individuals or partners to personal financial risks.

Choosing the right structure depends on various factors, including the project’s scale, your risk tolerance, and lender preferences. Each structure has its own set of financial and tax implications, making it advisable to consult with financial and legal experts for your specific needs.

Interest rates & fees

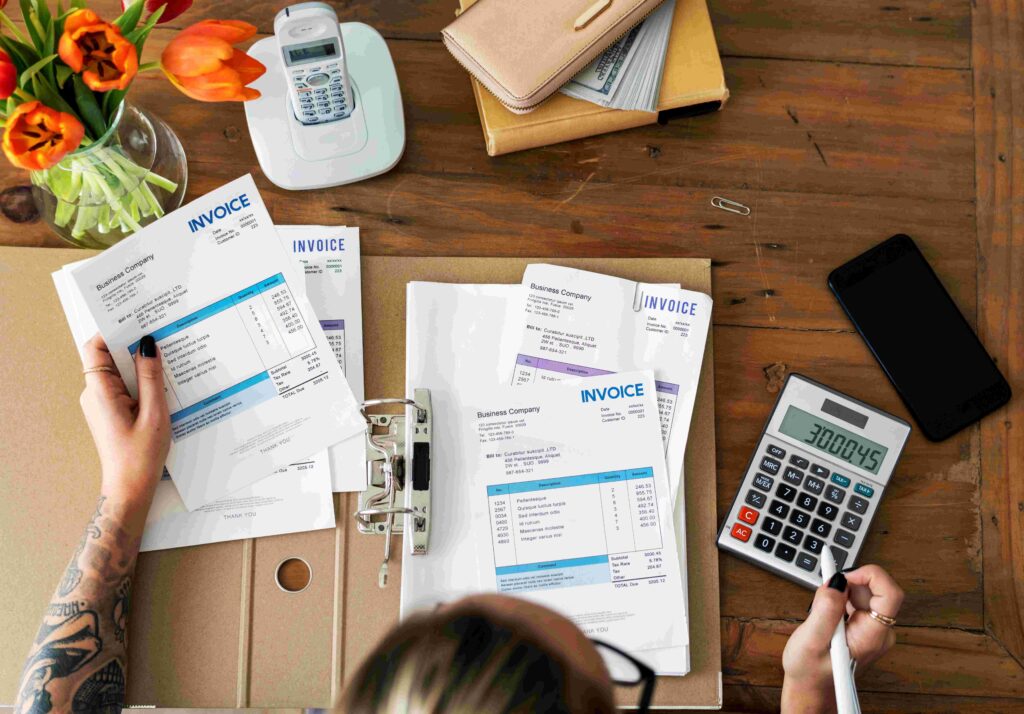

Understanding the cost implications of Property Development Finance is essential for any developer. The two primary cost components are interest rates and fees, both of which can vary significantly depending on the lender and the specifics of your project.

- Interest Rates: These are usually charged on a monthly basis and can be either fixed or variable. A lower interest rate doesn’t necessarily equate to lower overall costs, as other fees may apply.

- Arrangement Fees: These are one-time fees charged for setting up the loan, usually calculated as a percentage of the loan amount. Some lenders may offer lower interest rates but charge higher arrangement fees, making it crucial to consider the total cost.

- Exit Fees: Some lenders charge a fee upon loan repayment, especially for early repayment. This fee is typically calculated as a percentage of the Gross Development Value (GDV) or the loan amount.

- Valuation, Legal Fees, and Monitoring Surveyor Costs: These are additional costs for services like property valuation, legal advice, and the services of a monitoring surveyor, which is often a lender requirement. While some lenders include these in the overall loan package, others charge them separately.

- Additional Costs: Other potential costs could include broker fees or penalties for defaulting on the loan. There may also be costs for other professional reports that might be required, for example, if the valuer or monitoring surveyor identifies additional risks within their reports.

It’s worth noting that lower interest rates and fees often correlate with lenders who are more risk-averse and willing to finance only low-risk projects at lower levels. Therefore, the cost of borrowing may reflect the lender’s flexibility and risk appetite.

The Importance of a Strong Exit Strategy

A well-defined exit strategy is crucial when taking out a Property Development Finance loan. Given the short-term nature of these loans, usually ranging from 6 to 24 months, having a clear plan for repayment is essential. Here are some common exit strategies:

Sales Proceeds: One of the most straightforward exit strategies is to sell the developed units and use the sales proceeds to repay the loan. In some cases, repayment can be made in tranches as each unit is sold, reducing the interest burden.

Development Exit Finance: If the property hasn’t sold by the time the development loan matures, Development Exit Finance can offer a lifeline. This is a form of bridging loan that allows you to repay the original loan, often at a lower interest rate, giving you additional time to sell the property.

Long-Term Refinancing: If the intention is to retain and let the properties, then refinancing to a suitable long-term loan product is a viable exit strategy. This could be a commercial mortgage or a Buy-To-Let mortgage, depending on the scale and purpose of the development.

Understanding your exit options and planning accordingly not only provides peace of mind but also potentially saves you money by aligning your repayment strategy with the most cost-effective financial products available.

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Finance Solutions

questions

&

Answers

Development finance can cover a wide range of projects, including residential, commercial, and mixed-use developments. This can range from new builds to conversions and renovations.

The loan term is usually short-term, generally ranging from 6 to 24 months, although this can be extended depending on the project's complexity and duration.

An exit strategy is a well-defined plan outlining how the loan will be repaid. Common exit strategies include selling the developed property or refinancing it with a longer-term loan.

The amount you can borrow varies by lender but generally starts from £200,000 and can go up to £50 million. The loan amount is often determined by the project's gross development value (GDV).

Interest rates can vary widely, ranging from approximately 7% to 15% APR. The rate will depend on various factors such as the lender, the risk profile of the project, and the borrower's creditworthiness.

Yes, there are multiple fees to consider. These can include lender arrangement fees, broker fees, monitoring surveyor fees, exit fees, and legal fees. Each fee varies in amount and when it is due.

Most lenders will require full planning permission to be in place before they will issue a loan. This is to mitigate the risk associated with the development.

While it may be more challenging for first-time developers to secure funding, some lenders will provide loans to those without a track record in property development. In these cases we may need to build a strong case to show how risks can be offset.

Yes, some lenders are willing to offer loans to developers with bad credit, although the terms may be less favourable and additional security may be required.

Bridging finance is a short-term loan that serves as a financial bridge between two property-related transactions. It's often used to quickly secure a property before longer-term financing can be arranged.

Mezzanine finance is a secondary line of borrowing that sits behind the primary development loan. It's typically used to reduce the amount of cash deposit required from the developer.

This is a form of bridging loan that can be taken out after a development project is complete but not yet sold. It allows the developer to repay the more expensive development loan and possibly reduce monthly payments.

A Joint Venture involves a partnership between a developer and a financier. The financier funds up to 100% of the total deal value in exchange for a share of the profits upon completion.

Lenders typically look at a variety of factors when assessing an application for development finance. These can include the borrower's experience in property development, the viability and profitability of the proposed project, the location of the development, and the strength of the exit strategy. They may also require full planning permission and a detailed cost breakdown, among other documents, to fully assess the risk associated with the loan.

LTC stands for Loan to Cost, which is the ratio of the loan amount to the total cost of the project. LTGDV stands for Loan to Gross Development Value, which is the loan amount as a percentage of the project's expected market value upon completion.

An SPV is a temporary company set up to isolate financial risk. It acts as a separate legal entity for the duration of the development project, holding the property and the funds.

Lenders usually require a range of documents, including full planning permission, a detailed cost breakdown, evidence of the borrower’s development experience, and a schedule of works.

A monitoring surveyor is appointed to oversee the development, ensuring it complies with building regulations and the terms of the loan agreement. They often release funds in stages based on project milestones.

Yes, it's possible to refinance the development loan with a new, long-term loan or a development exit bridging loan, often at a lower interest rate.

make

an

enquiry

News, Views And Finance Clues

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Commercial Finance Solutions

More News, Views And Finance Clues

EXPERT EVALUATION, EFFECTIVE EXECUTION

Supporting UK businesses with access to Finance That Fits