Merchant Cash Advance (MCA)

Finance for businesses that accept card payments

Merchant Cash Advance (MCA)

Merchant Cash Advance (MCA) provides a unique and flexible funding solution for businesses seeking quick cash flow support. MCA is specifically designed for businesses that accept card payments, whether in-person, online, or via telephone. The available loan amount is proportionately linked to established or past card sales.

MCA is advantageous for various industry sectors. It is often particularly beneficial for retail stores, restaurants & takeaways, and those operating in the hospitality and leisure sectors

YOUR PROJECT, OUR MISSION

Supporting UK businesses with access to Finance That Fits

Who is MCA for

Merchant Cash Advance (MCA) could be used by any businesses that take payments from their customers by card, face-to-face or online. It’s particularly prevalent in the hospitality sector, including restaurants and hotels, and is popular among retail and services businesses, especially small high street shops engaging in face-to-face customer transactions. The trend is also growing among online retailers and e-commerce websites.

Security is not typically required for MCA. Advances are based on business performance and card turnover, with repayments being made automatically as a pre-agreed percentage of future sales.

MCA can be a viable option for new businesses or those with a poor credit record. Even those who have been denied other types of funding might qualify for MCA. However, if the lender assesses a higher risk then this may result in a smaller loan amount and/or higher borrowing costs.

What can MCA be used for

MCA is most suitable to support a variety of short-term and urgent requirements, and generally there are no restrictions on the purposes it can be used for. Common uses include:

Temporary Cash Flow Support: MCAs can help cover expenses like payroll, utility bills, or rent during unexpected downturns in cash flow.

Purchasing Inventory: Businesses can use MCAs to buy inventory in bulk, reducing costs, or to stock up for a busy season or upcoming promotion without straining cash flow before profits roll in.

Boosting Marketing and Advertising: MCAs provide capital for new marketing campaigns, including online advertising and direct mail, to attract more customers and increase revenue.

Hiring New Employees: Whether for expansion or maintaining operations, MCAs offer the working capital needed to hire and onboard new team members.

Repairing or Purchasing New Equipment: MCAs can finance the repair or purchase of equipment and technology necessary for efficient business operations.

Building a New Website: For enhancing online presence, MCAs can fund the creation or improvement of a website, crucial in today’s digital marketplace.

Investing in Training and Education: MCA funds can be used for professional development, helping businesses offer new services and grow.

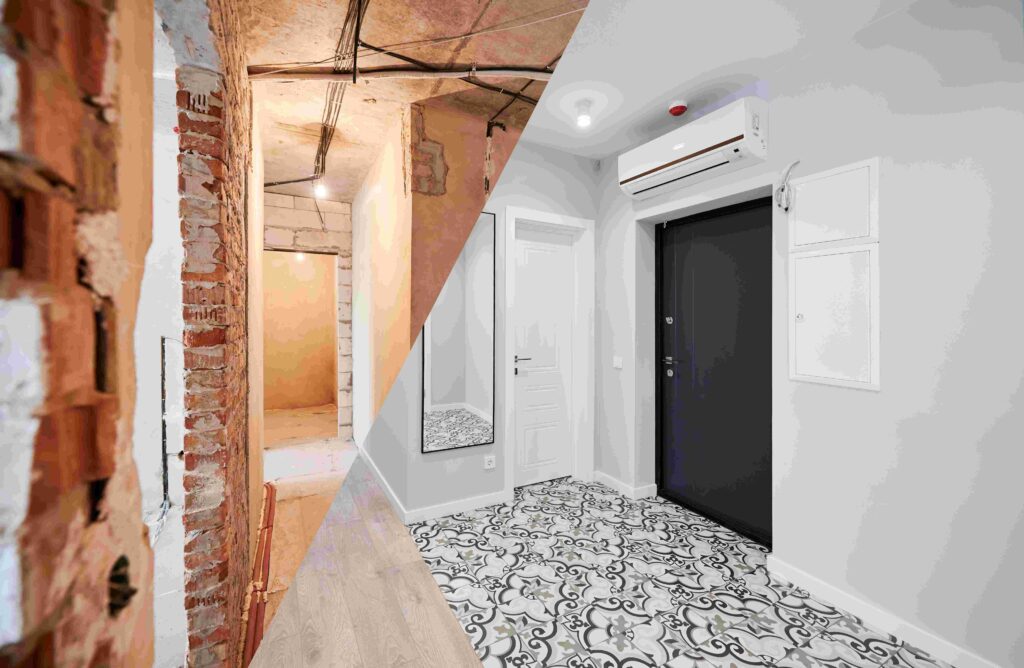

Remodeling or Expanding: Businesses can use MCAs for renovation or expansion projects, including moving to a larger space or opening new locations.

Covering Seasonal Costs: MCAs can help businesses prepare for high-season demands or manage cash flow during off-seasons, especially for seasonal businesses like landscapers and contractors.

Purchasing Raw Materials: Necessary for bidding on or initiating new projects.

Paying Off Other Debts: MCAs can be used to pay off existing high-interest debts, such as maxed-out credit cards.

Maximum borrowing via MCA

The maximum loan amount is proportionate to the borrowing business’s turnover. The maximum loan amount possible may be equal to 2.5x one-month of card turnover. This varies between the different MCA products that are available, and is contingent on various factors reviewed as part of the application process.

Advances generally range between £1,000 and £1,000,000.

Charges - Factor Rate

The charge for an MCA is calculated using what’s known as the Factor Rate, which differs from the Annual Percentage Rate (APR) used in traditional loans.

For instance, a £10,000 MCA at a 1.2x Factor Rate means that the borrower agrees to a Total Amount Repayable of £12,000, which is £2,000 more than they borrowed. However, unlike with a standard loan, the period over which the £12,000 will be repaid depends on the level of the borrowing business’s future card sales. If the borrowing business performs well, then the £12,000 will be repaid faster. Conversely, if it performs less well, then the £12,000 will be repaid more slowly.

Settlement - Repayment Percentage

With MCAs, repayments to the lender are calculated as a pre-agreed Repayment Percentage of future card sales, not a fixed monthly repayment. This is a key distinction from traditional loans, where a fixed monthly repayment is standard. With an MCA, the repayment amount each month varies according to the borrowing business’s performance – a set percentage of each sale progressively reduces the Total Amount Repayable until it reaches zero.

For example, if a 15% Repayment Percentage is agreed with the lender:

- Customer 1 transaction: £100 (The borrower keeps £85, the lender receives £15)

- Customer 2 transaction: £200 (The borrower keeps £170, the lender receives £30)

- Customer 3 transaction: £50 (The borrower keeps £42.50, the lender receives £7.50)

After these transactions, if the borrower had a Total Amount Repayable of £12,000, it would be reduced by £52.50 to £11,947.50.

As you can see, how fast the MCA is fully repaid will depend on how the borrowing business performs because repayments are lower when business is quieter, and higher when business is better.

Benefits & drawbacks

Benefits

- Speed: MCA can provide a fast and straightforward funding option. Approval processes are typically quick, often resulting in funding within 24 hours.

- High Approval Rates: Easier to qualify for than traditional loans, MCA can be used for various business needs.

- Flexibility: Repayments are made from customer card payments, linking repayment to sales and aiding cash flow management.

- Unsecured Finance: MCA does not require collateral such as business assets or property.

- Simplified Application: Unlike some traditional loans, MCA doesn’t necessitate a business plan. Lenders focus on sales data, often accessible online, simplifying documentation requirements.

- Less Emphasis on Credit Ratings: With access to past card sales data, lenders rely less on credit ratings.

- Reduced Default Risk: Automatic deductions from customer card payments lower the risk of default and late payment fees.

Drawbacks

- Fees: MCA can be expensive, especially if the facility is continuously renewed, effectively turning into a solution for long-term funding requirements. Ideally, MCAs are more appropriate for addressing immediate or short-term financial needs. Therefore, it is crucial that we gain a thorough understanding of your business and your plans. This understanding allows us to ascertain whether an MCA is the most suitable option for your specific circumstances. Additionally, we commit to regular reviews with the borrower to ensure that the most appropriate facilities are in place, and to review options to refinance to alternatives where appropriate.

- Dependence on Current Turnover: Borrowing capacity is based primarily on current turnover, not future projections.

- Exclusion of Non-Card Revenue: When the lender assesses how much they may be prepared to advance they will consider your established/ past card turnover but they will not consider amounts of your turnover received through other modes, e.g. BACS or cash.

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Finance Solutions

questions

&

Answers

Yes, we charge a transparent and fair fee of 0.5% that's typically payable at the end when the loan completes, and in our opinion borrowers should be extra cautious if a broker ever offers to work without charging fee. In these circumstances the broker's income may be based solely on commissions paid by lenders, and commissions vary significantly between different lenders, so the borrower needs to be confident that the broker is not inappropriately influenced by lender commissions. It is critically important that the broker has the borrowers best interests front & centre when presenting choices and making recommendations. Our fee is modest, and if you take a look at what it represents as a portion of borrowing costs over the loan term, you'll see why we're confident it will be far outweighed by the savings we achieve for borrowers and the value of the close support and guidance we provide.

Click here to find out more.

make

an

enquiry

News, Views And Finance Clues

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Commercial Finance Solutions

More News, Views And Finance Clues

EXPERT EVALUATION, EFFECTIVE EXECUTION

Supporting UK businesses with access to Finance That Fits