Owner Occupied Commercial Mortgages

For finance secured on the borrowers trading premises

Owner Occupied Commercial Mortgages

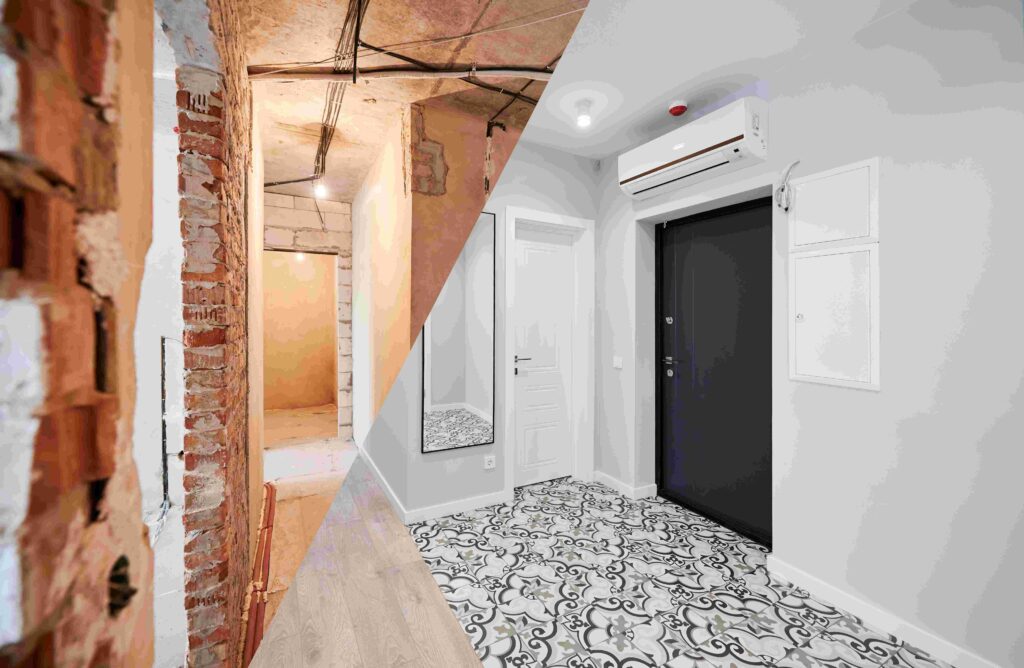

Owner Occupied Commercial Mortgages are loans secured against a business’s trading premises, designed for a wide array of trading businesses that own their operational spaces. This type of mortgage is ideal for various purposes: whether acquiring new property, refinancing an existing mortgage on more favourable terms, or releasing equity for purposes like business expansion. The range of options available varies significantly, tailored to suit different industry sectors, credit profiles, and property types. These mortgages offer a strategic financial tool for businesses seeking to leverage their property assets to support and grow their operations. Below, we provide insights to aid your decision-making before initiating a detailed discussion and application with us.

YOUR PROJECT, OUR MISSION

Supporting UK businesses with access to Finance That Fits

The Lenders View

Lenders evaluate a variety of factors when assessing an Owner Occupied Commercial Mortgage application. One key advantage of working with Fit To Lend is our commitment to ensuring lenders fully appreciate the relevant merits and strengths of your business, and our focus on delivering the right outcome helps to alleviate the stress sometimes felt by borrowers during the application process.

Here are some of the factors that most lenders will think about when assessing an Owner Occupied Commercial Mortgage application:

Financial Health and Property Viability: Lenders meticulously analyze the business’s financial strength, focusing on factors like loan-to-value ratios, operational income, and long-term financial sustainability. They also consider the property’s adaptability for various business uses, ensuring flexibility and resilience in changing market conditions.

Business and Property Location: The business location, accessibility, and local market demand are crucial. Lenders evaluate the property’s location in relation to its suitability for the business, potential customer or client access, and its impact on business continuity.

Management Experience and Business Acumen: In today’s dynamic market, a borrower’s experience in managing a business, particularly understanding market trends and regulatory requirements, is vital. Lenders look for applicants with proven business management skills and a robust plan for future growth and adaptation.

Valuation and Market Analysis: The importance of a comprehensive property and business valuation is paramount. Lenders rely on detailed assessments to understand market trends, rental values, and the property’s suitability for the proposed business use. This analysis includes considerations of market dynamics and future potential.

Income Stability and Asset Liquidity: The primary focus is on the business’s ability to generate steady income and sustain the mortgage. Lenders assess the potential for income fluctuations and the property’s resale value, considering factors like business model viability and market position.

Regulatory Compliance and Planning Permissions: Ensuring that the property meets all relevant regulations and planning permissions is essential. This includes compliance with environmental standards, building regulations, and any industry-specific legal requirements.

Risk Mitigation and Strategy: Lenders assess the overall risk associated with the mortgage, including the business’s contingency plans, market position, and the ability to adapt to economic changes. This comprehensive approach ensures that both the lender and borrower are aligned in their understanding of the market and the business’s potential.

Now, let’s explore how these overarching lending criteria are uniquely applied in each sector, highlighting specific factors that lenders scrutinize to tailor their assessment according to the distinct nature of these industries.

Construction

Includes general contractors and specialty trades like electricians. Lenders evaluate project feasibility, asset value, and completion history. The focus is on the stability of ongoing and future contracts and the value of owned equipment and properties.

Professional, Scientific, and Technical

Covers law firms, architectural studios, and IT consultancies. Lenders consider client diversity, billable hours, and the value of intellectual property. The assessment includes client portfolio analysis and billing consistency.

Wholesale and Retail Trade

Comprises clothing retailers, electronics stores, and e-commerce platforms. Lenders assess store locations, online presence, and inventory management. Inventory turnover and digital market reach are key factors.

Administrative and Support Service

Includes employment agencies and cleaning services. Lenders look at contract lengths, client retention, and operational efficiency. The focus is on contract stability and business processes.

Other Service Activities

Encompasses beauty salons, auto repair shops, and laundry services. Lenders evaluate location attractiveness, service demand, and customer loyalty. Assessment includes local market presence and range of services offered.

Human Health and Social Work

Covers GP surgeries and dental practices. Lenders focus on patient numbers, service quality, and regulatory compliance. Care homes are assessed for occupancy rates and care quality ratings.

Loan to Value (LTV)

The Loan to Value (LTV) ratio in commercial mortgages varies significantly across different industry sectors, reflecting the diverse risk profiles and financial characteristics inherent to each sector.

Typically, lenders offer LTV ratios up to 70-75% of the purchase price, or value, in commercial mortgages, subject to their valuation and specific lending criteria. This ratio indicates the proportion of a property’s value that can be covered by the loan, with the remainder usually covered by the borrower’s deposit. There can be sector-specific variations – here are some examples:

Healthcare Industry

In sectors like healthcare, which often includes businesses like GP surgeries, dental practices, and care homes, lenders may offer higher LTV ratios. This is due to the stable and guaranteed income streams typically associated with healthcare businesses. In some cases, LTVs can reach up to 100% for top-rated businesses in this sector.

Retail and Wholesale Trade

For sectors such as retail and wholesale, the LTV might be influenced by factors like store location, foot traffic, and inventory turnover. The property’s adaptability for different uses in changing market conditions can also affect the LTV ratio offered.

Professional, Scientific, and Technical Services

In these sectors, which include businesses like law firms and IT consultancies, LTV ratios might be impacted by the client diversity and billable hours, which influence the overall financial stability of the business.

Construction

For construction companies, the LTV ratio may be influenced by the feasibility and value of ongoing projects, as well as the stability of future contracts.

Administrative and Support Services

In this sector, contract stability and operational efficiency can play a role in determining the LTV ratio, given the impact on consistent revenue generation.

VAT Applicability: If the property involved in the mortgage is subject to VAT, this can significantly impact the LTV ratio. In some cases, the entire VAT cost (typically 20% of the purchase price) may be included in the funding, effectively increasing the LTV ratio.

Understanding the nuances of how LTV ratios are determined in each sector can help businesses prepare better for commercial mortgage applications, ensuring they align their expectations with lender preferences and sector-specific financial dynamics.

Borrowing Structure - Opco Propco Arrangements

In the world of commercial finance, particularly in the context of commercial mortgages, an increasingly popular arrangement is the Opco/Propco model. This structure involves splitting a company into at least two distinct entities: an Operating Company (Opco) and a Property Company (Propco).

Opco/Propco Structure: Essentially, in an Opco/Propco deal, a company divides itself into an Opco, which manages the business operations, and a Propco, which owns the real estate and associated revenue-generating assets. This structure allows for a clear separation of the operational aspects of a business from its property assets.

Ownership and Lease Arrangements: Typically, the Propco becomes the owner of the business’s real estate assets, while the Opco focuses on utilizing these assets to generate sales. The Opco usually leases the properties from the Propco, creating a tenant-landlord relationship within the same business entity. This arrangement can provide significant tax and financial benefits.

Financial and Business Development Advantages: The Opco, freed from the capital constraints of owning real estate, can focus its resources on business development. It sells its real estate assets to the Propco and then leases them back for operational use. This setup allows the Opco to redirect funds that would have been tied up in property towards other business development initiatives.

Purpose of the Propco: The Propco serves as a special-purpose vehicle for holding the property assets. By transferring the ownership of real estate assets to the Propco, the operational business can potentially achieve a more efficient capital structure and realize the value locked in its property assets.

The Opco/Propco model is particularly attractive in scenarios where businesses are looking to unlock capital tied up in real estate or when they want to segregate operational risks from property-related risks. It’s a strategy that requires careful consideration of the tax implications, legal structure, and long-term business goals. This structure is not just about financial engineering; it’s also about aligning business strategy with the optimal use of assets to enhance operational efficiency and financial robustness.

Contract Term, Amortization & Fixed Rates

Firstly, it is important to distinguish between the Contract Term, Amortization Profile, and Fixed Rate Term:

Contract Term: This refers to the total duration of the mortgage contract. It’s the period during which the borrower is legally bound to the mortgage agreement’s terms with the lender. At the end of the contract term, the mortgage is either fully paid off, or a remaining balance must be refinanced or paid in full. For an Owner Occupied Commercial Mortgage, the available Contract Term may vary based on the lender’s industry-specific criteria, but typically ranges between 5 and 25 years.

Amortization Profile: This describes how loan payments are structured over time to pay off both the principal and interest. It details the schedule by which the loan balance is reduced throughout the contract term. Sometimes, the amortization period may exceed the contract term, leading to a balloon payment at the end where the remaining balance is due. For an Owner Occupied Commercial Mortgage, the available Amortization Profile can vary depending on the lender’s criteria, but typically spans 15 to 25 years, including Interest Only profiles.

In some instances, a lender may agree to an amortization profile that extends beyond the contract term or provide the loan on an interest-only basis. In both scenarios, a lump-sum payment to settle the remaining loan balance is due at the contract term’s conclusion.

Fixed Rate Term: This period within the overall contract term features a fixed interest rate. The fixed rate term ensures stability in repayment amounts, as the interest rate is not affected by market fluctuations during this time. Once the fixed rate term concludes, the loan may switch to a variable rate or undergo renegotiation.

Typically, if a fixed rate period is agreed upon, it tends to be shorter than the loan’s contract term, usually lasting up to 5 years.

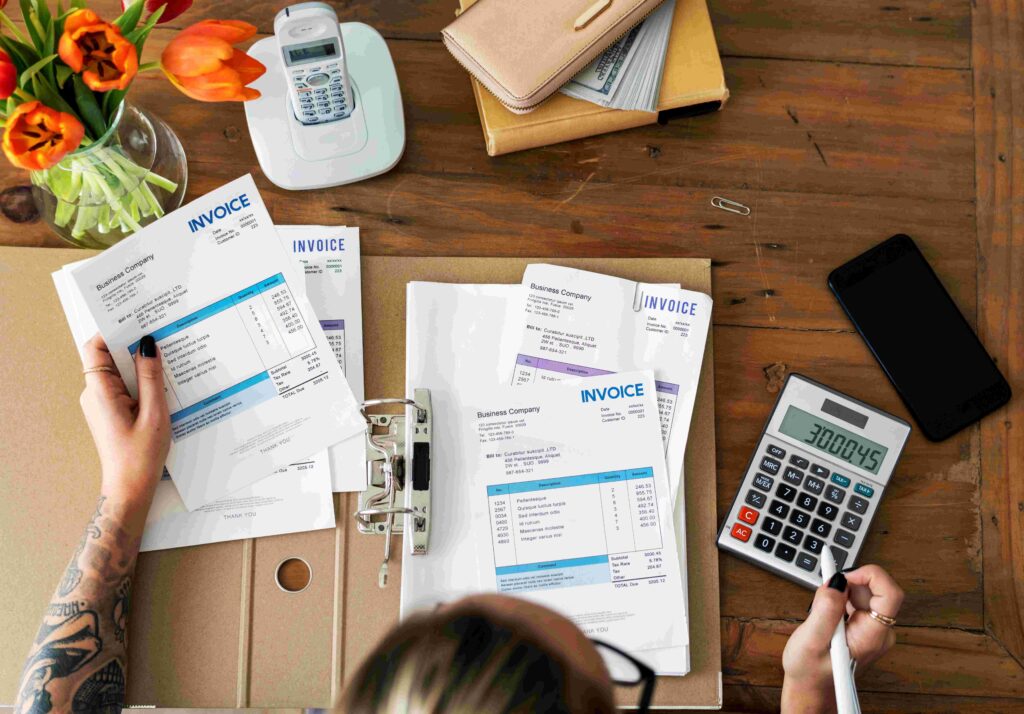

The application, approval, and completion processes

The application process for Owner Occupied Commercial Mortgages involves meticulous preparation and presentation of the required documentation. Fit to Lend offers comprehensive support throughout this journey, beginning with a detailed assessment of the borrower’s circumstances, needs, and plans. We specialize in identifying the most suitable product that aligns with the borrower’s objectives.

Our role extends beyond mere facilitation; we endeavor to craft a credible and persuasive proposal to enhance the likelihood of lender approval and to secure an offer on terms most favorable to our client. By remaining actively involved at every stage — liaising with borrowers, lenders, valuers, and solicitors — we navigate the complexities of the process to meet your completion timeline. Our commitment is to ensure that from the initial application to final completion, every step is handled with diligence and expertise. This approach minimizes delays and aligns with your business goals, ensuring a smooth transition throughout the financing journey.

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Finance Solutions

questions

&

Answers

Yes, we charge a transparent and fair fee of 0.5% that's typically payable at the end when the loan completes, and in our opinion borrowers should be extra cautious if a broker ever offers to work without charging fee. In these circumstances the broker's income may be based solely on commissions paid by lenders, and commissions vary significantly between different lenders, so the borrower needs to be confident that the broker is not inappropriately influenced by lender commissions. It is critically important that the broker has the borrowers best interests front & centre when presenting choices and making recommendations. Our fee is modest, and if you take a look at what it represents as a portion of borrowing costs over the loan term, you'll see why we're confident it will be far outweighed by the savings we achieve for borrowers and the value of the close support and guidance we provide.

Click here to find out more.

A buy-to-let mortgage is for purchasing or refinancing a property that is, or intended to be, rented out.

Yes, both fixed and variable rate options are available.

Usually up to 75%, but can vary based on lender criteria.

Yes, bridge loans usually require property or another high-value asset as collateral.

Interest rates are based on factors like LTV, loan term, and borrower's credit profile.

Anything between a few weeks and a few months. This can be case specific, but there are things we can do to expedite matters.

Purpose is always important to the lender, and property improvements is usually an acceptable purpose.

Generally no, but some lenders may have sector preferences.

It's not uncommon.

Yes, if they have sufficient collateral, startups can access bridge finance for urgent needs.

Less emphasis is placed on income; more on collateral value and exit strategy.

Yes, they can be structured to cover financing for multiple properties if needed.

make

an

enquiry

News, Views And Finance Clues

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Commercial Finance Solutions

More News, Views And Finance Clues

EXPERT EVALUATION, EFFECTIVE EXECUTION

Supporting UK businesses with access to Finance That Fits