Property Portfolio Finance

For larger or more diverse property portfolios

Property Portfolio Finance

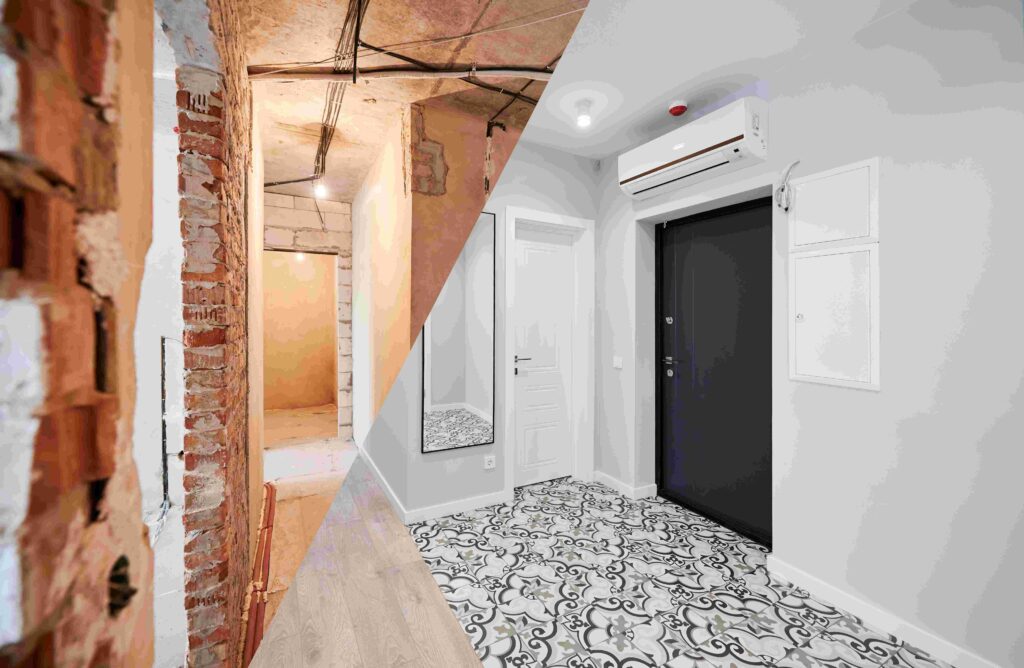

Property Portfolio Finance describes a range of products designed to support investors with larger or more diverse property portfolios. For those for whom individual mortgages may be impractical, or certain properties pose unique financing challenges, presenting them as part of a portfolio can provide a robust security base for lenders. This, in turn, can help borrowers achieve more favourable terms overall. Offering enhanced flexibility over standard mortgage product types, this approach can lead to preferable rates, decrease the need for frequent refinancing, and potentially reduce administrative and legal costs. By leveraging the collective value and income potential of your portfolio assets, we can assist in structuring tailored finance solutions to bolster your investment goals, fostering growth and stability across your portfolio.

YOUR PROJECT, OUR MISSION

Supporting UK businesses with access to Finance That Fits

Uniform & Diverse Property Portfolios

Property Portfolio Finance products can offer a streamlined and strategic approach to property financing. These financial products may be ideal for investors overseeing a larger number of similar properties, where individual mortgages could lead to complications, unnecessary refinancing, and administrative work. It also caters to varied portfolios by enabling the consolidation of different property types — from commercial spaces with varied lease terms to entire industrial estates and residential units — into one manageable loan with a lender who is willing to adopt a structured, aggregated approach. This cohesive financing solution is designed to simplify portfolio management, enhance investment leverage, and facilitate growth.

Property Portfolio Finance offers remarkable versatility in collateral options, catering to a broad spectrum of asset types. While rental properties — encompassing both residential and commercial — are commonly financed, property investors often manage more varied assets. For example, vacant plots of land may be included; they enhance the portfolio’s value, even if they do not yield immediate rental income. Similarly, income streams from atypical sources, such as telephone mast contracts, might offer limited security value but can contribute to debt service with their reliable revenue. These examples are illustrative rather than prescriptive, demonstrating the wide array of potential assets that this flexible funding solution can accommodate.

Flexibility in Property Portfolio Finance

Property Portfolio Finance can offer a spectrum of features to meet the specific needs of property investors and developers. Here are examples of the types of loan flexibilities that can be incorporated:

- Partial Security Release: For assets awaiting planning permission, provisions can be arranged for the release of individual assets from the security pool once consent is granted. This release may necessitate a review and potential adjustment of the loan balance. Such a partial release may be essential for offering development land to support finance from a different lender or so that land can be sold at a profit after planning permission has been obtained.

- Staged Drawdown Facilities: Borrowers may seek a facility that allows a smaller initial drawdown (e.g., for repaying existing debt), with the remaining balance available to draw upon on-demand later to support a purchase.

- Incremental Funding: Borrowers may require the option to increase borrowing against the security they have provided to a lender once they have enhanced those assets, for instance, after completing a development scheme to be retained as an investment or after extending an existing investment asset, thereby increasing its value and rental yield.

- Flexible Repayment Terms: Tailored repayment terms may be necessary to align with the income cycles of the property portfolio, ensuring congruence with cash flow patterns. For instance, a loan may be structured with an interest-only period scheduled to conclude in tandem with the completion of a development scheme, which will then generate income to service capital and interest repayments.

- Revolving Credit Lines: A revolving credit option can be established for portfolios with ongoing funding requirements, ensuring a consistent access to capital.

These features underscore the adaptability that can be offered by Property Portfolio Finance, equipping borrowers with the tools to manage their portfolios effectively while strategizing for future growth and development.

The Lenders View

When it comes to Property Portfolio Finance, lenders meticulously assess both the borrower’s profile and the assets being financed. Here are the critical factors lenders consider:

Borrower Experience and Expertise:

Lenders closely evaluate the borrower’s experience, especially for portfolios that include assets requiring intensive management or development. A proven track record in property management or a history of successful development projects can significantly influence a lender’s confidence. For portfolios with redevelopment plans, lenders may look for evidence of the borrower’s development experience or intentions to engage experienced contractors to ensure project completion.

However, in cases where the portfolio is uniform or simpler, the borrower’s experience may not weigh as heavily in the lender’s evaluation. Instead, the focus may shift to the financial metrics of the portfolio.

Financial Health of the Portfolio:

Lenders will analyse the portfolio’s loan-to-value ratio and the rental income in relation to loan repayments. A portfolio that presents a lower risk through strong financial metrics may lead to a less stringent assessment of the borrower’s experience.

Income Generation and Asset Liquidity:

The lender’s primary concern is the portfolio’s ability to generate sufficient income to service loan repayments. They will review historical financial performance and projected cash flows to determine the viability of the loan. Additionally, in some cases a lender may consider the liquidity of the assets, taking into account how quickly and easily a property could be sold, whether as a strategic exit or in response to a financial emergency.

In sum, while lenders may tailor their scrutiny based on the unique characteristics of the portfolio and the borrower’s background, the overarching goal is to ensure that the loan is supported by a sound investment strategy and is backed by viable, income-producing properties.

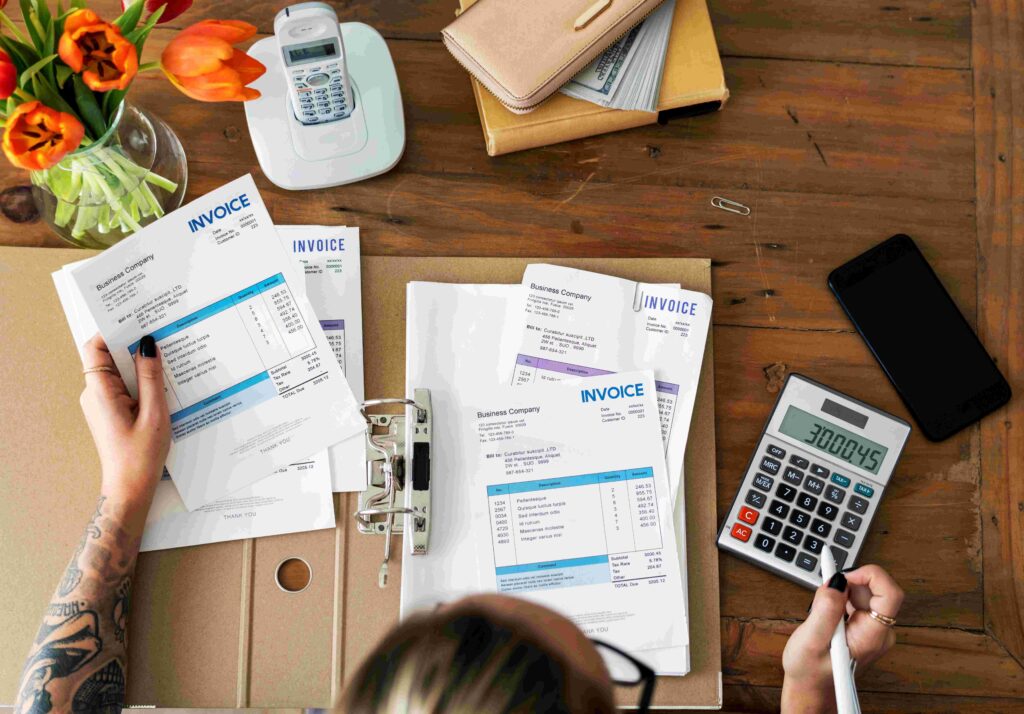

Interest rates & fees

Property Portfolio Finance usually incorporates a fairly standard structure of interest rates and fees, similar to other mortgage types. An arrangement fee is typically charged for setting up the loan. Interest rates may be fixed or variable, with potential costs at loan termination, especially if it occurs before the end of a contract term or fixed-rate period.

However, Property Portfolio Finance can offer a broader array of options. Variable rates may be tied to financial indices like LIBOR, SONIA, or the Bank of England Base Rate. Beyond standard fixed-rate periods, borrowers can also consider hedging products that provide interest rate protection separate from the loan itself, offering additional flexibility and risk management.

Pricing for Property Portfolio Finance is often risk-adjusted, which means that the exact interest rates and fees are determined based on the specific risk profile of the portfolio and borrower. Consequently, precise pricing is typically available only after a formal application has been submitted and reviewed. Nonetheless, early-stage guidance on pricing can usually be provided, giving borrowers an indicative range based on preliminary information.

The application, approval, and completion processes

The application process for Property Portfolio Finance can be meticulous, with the lender evaluating multiple factors to ensure the viability of the proposal, but don’t worry – we’re here to help by:

- Understanding you, your business, your portfolio, your plans and what you want.

- Identifying the best lender and product to meet your needs.

- Negotiating advantageous terms.

- Assisting with document and information preparation.

- Presenting a strong, well-structured loan application to the lender.

- Coordinating with the lender, valuer, solicitor, you and whoever is required to achieve completion consistent with your timetable.

We’ll help to make complex processes easier, from the initial review to the final steps.

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Finance Solutions

questions

&

Answers

Yes, we charge a transparent and fair fee of 0.5% that's typically payable at the end when the loan completes, and in our opinion borrowers should be extra cautious if a broker ever offers to work without charging fee. In these circumstances the broker's income may be based solely on commissions paid by lenders, and commissions vary significantly between different lenders, so the borrower needs to be confident that the broker is not inappropriately influenced by lender commissions. It is critically important that the broker has the borrowers best interests front & centre when presenting choices and making recommendations. Our fee is modest, and if you take a look at what it represents as a portion of borrowing costs over the loan term, you'll see why we're confident it will be far outweighed by the savings we achieve for borrowers and the value of the close support and guidance we provide.

It's a loan for investors to fund multiple properties as a single portfolio.

It covers a wider range of property types and can be secured against multiple properties.

Yes, this financing can cover diverse properties within a single portfolio.

Lenders evaluate borrower experience, property income potential, and financial stability.

Yes, especially for those with diverse assets and development plans.

Yes, lenders can allow partial release upon planning permission approval.

Yes, borrowers can access funds incrementally for project phases.

Yes, borrowing can be increased based on improved asset value and yield.

Yes, lenders offer interest-only periods to align with development and income cycles.

It's a flexible credit facility allowing repeated borrowing within an agreed limit.

It involves preparing a detailed proposal, negotiating terms, and coordinating with professionals.

Requirements vary by lender, with some setting minimum values or number of properties.

Ratios vary, but most lenders offer up to 70-75% of the portfolio's value.

Provide complete, accurate documentation and respond promptly to lender inquiries.

Yes, this is possible. More commonly assets that have a significant value but produce no rent might be be well suited to Bridge Finance. However, as part of a portfolio, which is strong in respect to rents but inadequate value to support the target loan amount, an asset that doesn't produce rent may provide a useful contribution to loan security, and allow for a higher lending limit.

Yes, land with development potential can be part of the security.

Lenders can arrange for asset disposals within the portfolio under agreed terms.

Rates are based on loan size, portfolio risk, borrower's financials, and market rates.

make

an

enquiry

News, Views And Finance Clues

working with lenders, for borrowers

Supporting UK businesses with access to Finance That Fits

Other Commercial Finance Solutions

More News, Views And Finance Clues

EXPERT EVALUATION, EFFECTIVE EXECUTION

Supporting UK businesses with access to Finance That Fits