Conveyancing in the UK: A Systemic Issue?

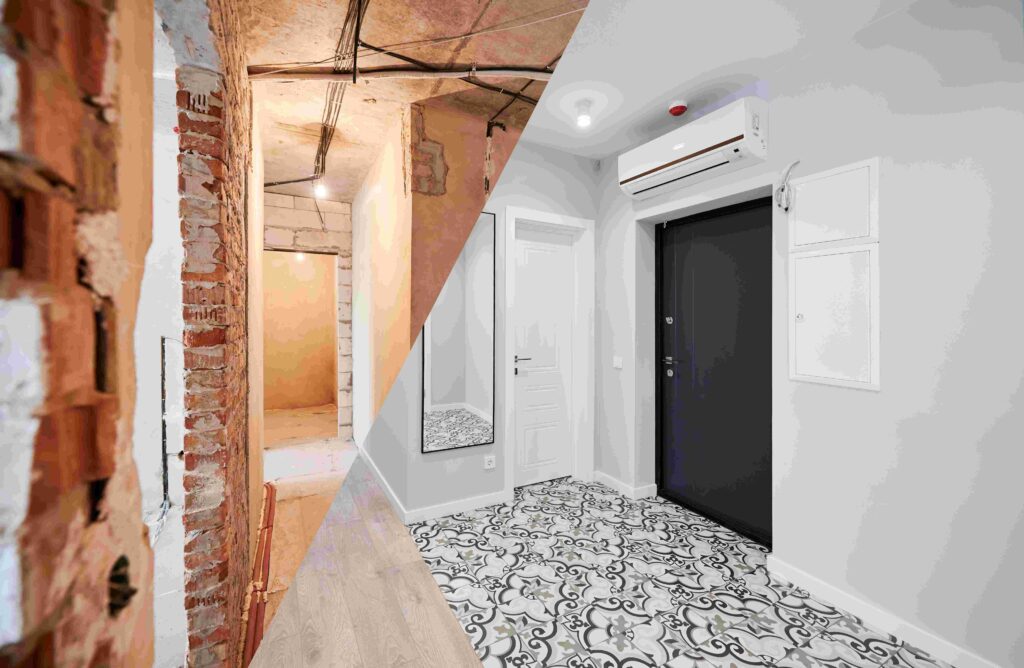

The UK conveyancing system, integral to property transactions, is often viewed by many stakeholders as falling short of expectations, particularly regarding speed. While it’s clear the system is evolving, the pace of change has been a point of concern for many.

Traditional practices still persist in conveyancing. Stakeholders express that at times the reliance on manual record-keeping, paper-based transactions, and postal communications contributes to the overall slowness of the process. This traditional approach, thorough as it may be, can lead to extended turnaround times and is seen as an impediment in an increasingly digital world.

In recent years, however, there has been a gradual shift towards technology in conveyancing. This evolution, driven by the need for efficiency and improved client experience, includes the adoption of digital platforms, electronic signatures, and online communication tools. These technological advancements, though welcomed by many, have yet to fully replace the older, more established methods, resulting in a hybrid system that sometimes causes inconsistencies in service delivery.

A frequently cited area for improvement by professionals is the involvement of local government agencies. The process of obtaining various conveyancing searches is often highlighted as a bottleneck, with many stakeholders viewing local agencies as slow adopters of technology, significantly contributing to delays in the conveyancing process.

Looking to the future, there is growing expectation and hope among stakeholders that the conveyancing sector will more fully embrace Artificial Intelligence (AI) and digital systems. The potential of these technologies to significantly impact the speed of property transactions is widely acknowledged. Automating routine tasks and enhancing accuracy, AI and digital tools could greatly streamline the conveyancing process.

However, the advancement of AI and digital systems is not without its challenges. A notable concern is the potential disruption to traditional job roles within the industry. As more tasks become automated, the role of conveyancers and solicitors may need to evolve, requiring new skills and adaptability. Additionally, ensuring data security and privacy in a digital environment is an increasingly important consideration.

So, while technological advancements in the UK conveyancing system are viewed positively by many, a balance may need to be struck. Integrating new technologies while maintaining high standards of service and security will continue to be a key demand. As the industry adapts to these changes, it will be interesting to see how it manages to reconcile the benefits of technology with the need to preserve traditional roles and ensure data security.

At Fit To Lend, we will continue to closely manage our client transactions, liaising with all parties, keeping clients up to date, and coordinating with solicitors, surveyors, and lenders to ensure that our clients’ transactions are delivered on time.

Fit To Lend: Specialist in Commercial Finance, offering advice, support, and a comprehensive range of solutions.

FINANCE MADE CLEAR, SUCCESS MADE POSSIBLE

Supporting Business With Finance That Fits

Property finance products

other business finance products

YOUR PROJECT, OUR MISSION

Supporting Business With Finance That Fits